Analyzing Correlation between Investment Assets

Photo by Pietro Jeng on Unsplash.com

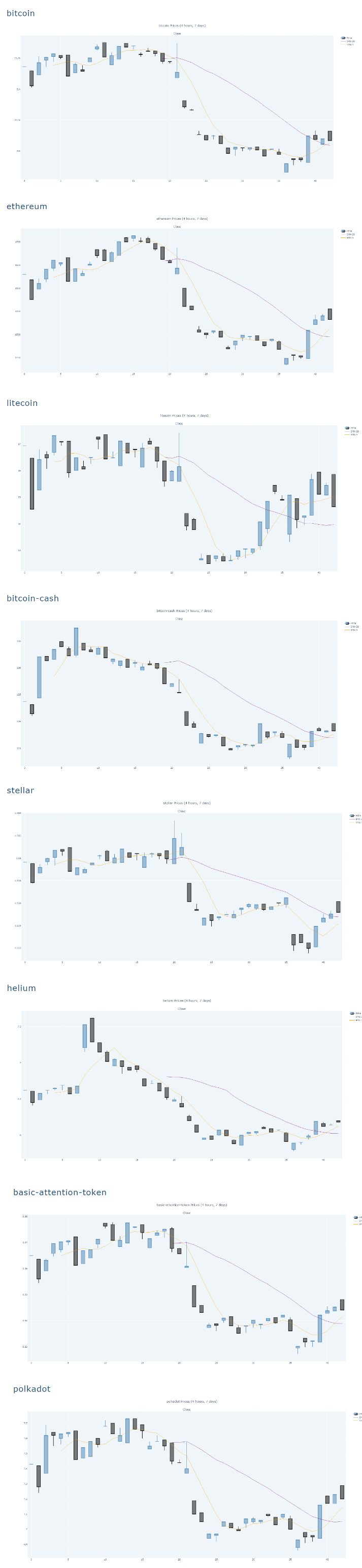

The other day I noticed something interesting. Check out the plots of one minute large-cap crypto prices over the last 4 hours. Yep, they look pretty similar. If there’s a close correlation between them, we may be able to leverage trend changes of the dominant asset as buy/sell signals for the dependent one.

If you’d like to find out how to measure correlation between to investment assets, this post is for you.

This story is solely for general information purposes, and should not be relied upon for trading recommendations or financial advice. Source code and information is provided for educational purposes only, and should not be relied upon to make an investment decision. Please review my full cautionary guidance before continuing.

What is Correlation?

Correlation is statistical relation ship of dependence between two variables or data sets. In statistics, correlation often refers to the degree in which two variables are linearly related.

In this post we are going to examine the correlation of prices, in particular the relation between the close prices of two assets.